Congress tries to ban insider trading by its members

And groups rally to opposed cuts to the Government Watchdog

Media stories erupted recently about Rep. Nancy Pelosi’s (D-CA) financial dealings.

“Stock market watchdog claims Nancy Pelosi raked in $4.7M in a single day of trading,” reads one headline about the 38-year House member from San Francisco, who was speaker from 2007 to 2011 and 2019 to 2023.

“Nancy Pelosi outperforms major hedge funds with jaw-dropping gains in 2024, leaves Wall Street pros in the dust,” another report exclaimed.

This was not the first such press scrutiny. The California Democrat’s high-performing portfolio has long been the subject of critical media stories. Last year, for example, financial disclosures revealed the California Democrat had sold at least $500,000 in Visa stock a few months before the Justice Department announced an antitrust investigation of the firm. Three years ago, tech entrepreneur Chris Josephs built the Pelosi Stock Tracker, which displays her assets and their impressive performance.

As in the past, a spokesperson told the press that Pelosi “does not own any stocks, and she has no prior knowledge or subsequent involvement in any transactions.” The assets are in an account held by her husband, Paul Pelosi, who is a very experienced investor and financier.

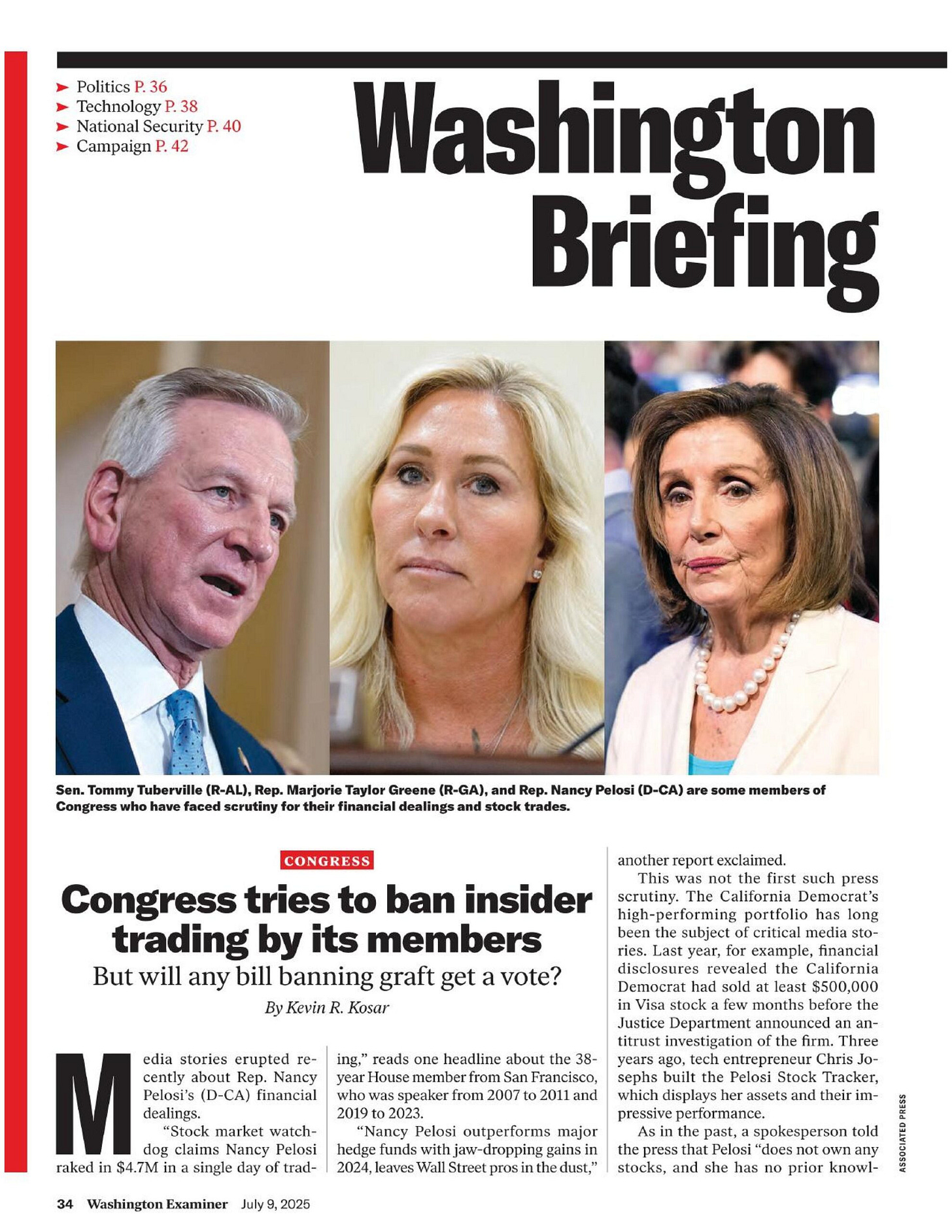

To be sure, the former speaker is not the only public official whose financial dealings have raised eyebrows. Nor are Democrats the only ones who are suspected of wheeling and dealing on Capitol Hill.

Sen. Tommy Tuberville (R-AL) sold Apple stock shortly before President Donald Trump announced tariffs that drove down the share prices. Rep. Marjorie Taylor Greene (R-GA) purchased a bevy of technology stocks shortly before Trump paused some tariffs — she told the press there was no problem as her investments are managed by an outside adviser.

These are among many people in Congress who often see gains in their stock portfolio that outpace the growth of the Standard & Poor 500…. (Keep reading)

More money for OMB but a cut to GAO’s budget?!

The House of Representatives recently passed legislation that would cut the budget of the Government Accountability Office (GAO) by nearly 50 percent. Adding insult to injury, it proposed increasing spending on the Office of Management and Budget.

Yes, you read that right. The GOP House voted “Yea” to weakening the taxpayer watch dog, the entity that audits and calls out executive agencies for waste, fraud, and abuse. And it wants to give more to the president’s budget office, which is abetting the Department of Government Efficiency’s refusal to spend legally appropriated funds.

Seriously?

Various civil society organization and good government groups have hollered. Already four letters have been sent to Congress explaining that money spent on GAO reduces total government spending. The American Governance Institute’s Daniel Schuman has compiled the various letters, blog posts, and such decrying the House’s move.

One might view the House’s action as peak parliamentary partisanship—you know, the latest example of legislators thinking it is their duty to support the president’s agenda. In this case, that agenda would be to make some cuts and to punish the GAO for doing its job—investigating various Trump appointees’s refusals to spend appropriated funds.

One also might view the proposed slash to GAO and boost of OMB as mostly symbolic politics. House Republicans want to make the President happy and send a message to GAO, however they assume the Senate will reverse the proposed cuts to GAO.

Anyway you slice it, the House GOP clearly still remains a party that thinks very little of Congress. They remain presidentialists at heart.

Why this is the case is taken up by my colleague Philip Wallach in his book Why Congress (Oxford University Press). It’s a long story rooted the Republicans’ misery at spending nearly four decade as a minority in Congress (roughly 1954-1994).

Getting more conservatives to become believers in the First Branch of Government is something I have been working on for more than a decade. There have been baby-steps forward, but there are miles to go before I can sleep.

On Another Note

Yesterday I published the latest issue of my Beverages, Books, and More. What’s in it? Various short bits compiled to amuse and entertain.

Wes Anderson discusses his films.

A top summer beach read.

A 46-year old whiskey.

Enjoy!

Well done. Yes, it is difficult to get Congress to focus on what is best for us citizens. Please see my Substack currently about Federal Debt, changing to electoral methods for Congress in August. Article coming Tuesday, July 15 on using a Congressional Commission to tackle the debt predicament. https://tommast.substack.com/p/enduring-fiscal-discipline-who-must?r=b29s7